- How to delete a scheduled transaction in quicken how to#

- How to delete a scheduled transaction in quicken update#

- How to delete a scheduled transaction in quicken download#

- How to delete a scheduled transaction in quicken mac#

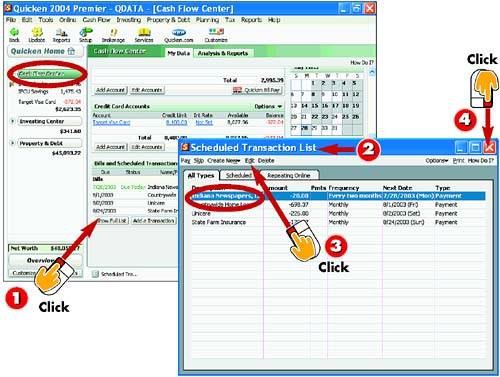

Your calendar will be automatically updated. This dialogue box will appear: Make the necessary changes and click OK. Did you know that you can also edit a transaction using the calendar Simply double click on the date that has the transaction you want to edit. They will provide you with great forecasting insights and allow you to see how your balance would look like if all Scheduled transactions were executed today. You can wait until Quicken reminds you to pay a scheduled transaction. When youre finished, click the Enter Transaction button.

How to delete a scheduled transaction in quicken download#

They are extremely useful if you don't use our automatic Online Banking feature and are entering transactions manually - if those transactions happen regularly, you can schedule them and have MoneyWiz enter them for you! Remember that Scheduled transactions do not need to be recurring - you can also use them to schedule one-off transactions or transactions that do repeat, but only for a finite amount of time.īut even if you're using Online Banking feature to automatically download transactions you can benefit from setting up your Scheduled transactions. Similarly, you would enter your paycheck as a deposit transaction in the same account. For example, you could enter check number 313 for 39.96 to McCarthy Produce as a payment transaction in your checking account.

How to delete a scheduled transaction in quicken how to#

Here you can learn how to create, edit, duplicate or delete them. Transactions Within each Quicken register, you enter individual transactions that correspond to your real-world income and expenses. These allow you to stop worrying about recurring transactions such as your income, bills, rent or even transfers to saving accounts. But the procedure I indicated is a lot easier and less steps and still keeps your unpaid bills in the reminder section to actually pay them.Scheduled transactions are basically transaction templates that can either be executed when you click on them or be executed automatically on a given date and time. Once again, if you've been doing this for 15 years, it works for you.

How to delete a scheduled transaction in quicken update#

Complete last transaction update before the change to get all of your transaction history up to date.

How to delete a scheduled transaction in quicken mac#

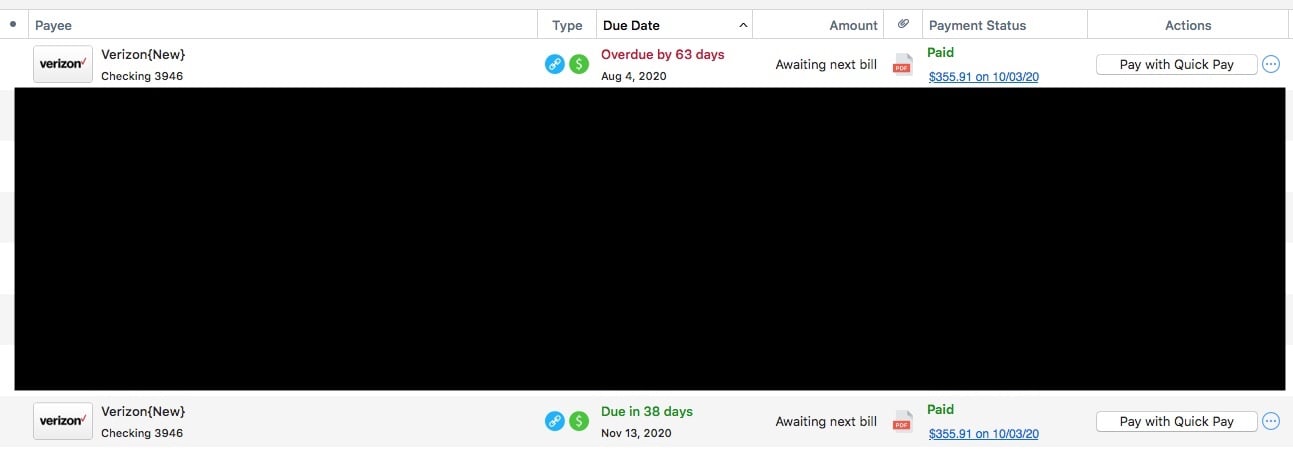

Or, you can just accept them as paid within the register itself. Backup Quicken Mac Data File and Update the application. The Stop Payments button allows you to view any Stop Payments that may. That way, there's no interaction on your part at all.it will automatically get entered into the register. CSV file, or download transactions for use in Microsoft Money, Quicken, or QuickBooks. Subtract the principal, 5,000, and you’re left with 858.88. A message will appear, confirming that youve successfully cancelled your payment. Select the Cancel button in the right column of the table. Multiply that payback amount by 48 and you get 5,858.88. Locate the payment you intend to cancel within the table on the main page. For this example, Quicken already told us we’re to pay back 122.06 per month for 48 months.

(Optional) Click OK to set up the scheduled transaction.

Click Options to set the options for your scheduled transactions. Enter scheduling information, such as the starting date and the frequency with which you want the transaction to recur.

And if you have bills that are set up with auto pay from the billers website, then you can have the Bill and Income reminder set to auto enter xx days in advance. But it’s an easy task to determine how much the total interest burden is going to be on the loan. Enter information about the transaction amount or the method Quicken should use when estimating the amount. Then, as you actually pay your bill you can go through the Bills and Income Reminders list and enter them AS THEY ARE PAID. This will then populate each register with reminders 12 months into the future, acting as your placeholder. You will have to do this for each individual register. Then, select "Reminders to show in the register" and select "Next 12 months". Click Yes to skip the current transaction or No to cancel. What you can do is in the transaction register, click on the gear in the upper right of the register above the search box. To skip the current transaction, for example, if you don’t intend to apply a transaction for a particular time period (for example, for the current month), in Scheduled Bills & Deposits, click Skip.

0 kommentar(er)

0 kommentar(er)